Navigating UK Mortgage Options as an Expat: A Simple Guide to Your UK Home Dream

Dreaming of owning a piece of the UK? For expats, the journey of Navigating UK Mortgage Options as an Expat: A Simple Guide to Your UK Home Dream can sometimes feel a bit overwhelming. But don’t worry, it’s absolutely achievable! This guide will break down everything you need to know to make your UK home dream a reality, simplifying the process step-by-step.

Understanding Expat Mortgages in the UK

First things first: what makes a mortgage ‘expat’? Essentially, an expat mortgage is designed for individuals who are UK nationals living abroad, or non-UK nationals residing outside the UK but looking to purchase property within it. Lenders often view expats differently due to factors like residency status, income source, and credit history.

Key Factors Lenders Consider

When you’re Navigating UK Mortgage Options as an Expat, lenders will typically scrutinize several key areas to assess your eligibility:

- Residency Status: Where do you currently live and work? This impacts tax implications and legal standing.

- Income Stability: Lenders need to see a stable, verifiable income, often preferring it in a major currency. Fluctuations and different currencies can be a hurdle.

- Deposit Size: Expats are often required to put down a larger deposit compared to residents, sometimes 25% or more.

- Credit History: A limited UK credit history can be a challenge, as lenders use this to gauge your reliability.

Types of Mortgages Available for Expats

While not all lenders offer expat mortgages, there are several products tailored to your needs. Understanding them is crucial for your UK home dream.

Buy-to-Let Mortgages

If you’re looking to invest in UK property to rent it out, a Buy-to-Let (BTL) mortgage might be your answer. The rental income generated from the property often plays a significant role in determining your eligibility and affordability.

Residential Mortgages

For expats planning to live in the property themselves, a Residential mortgage is what you’ll need. These often come with more stringent criteria regarding your intention to occupy the property and your long-term residency plans.

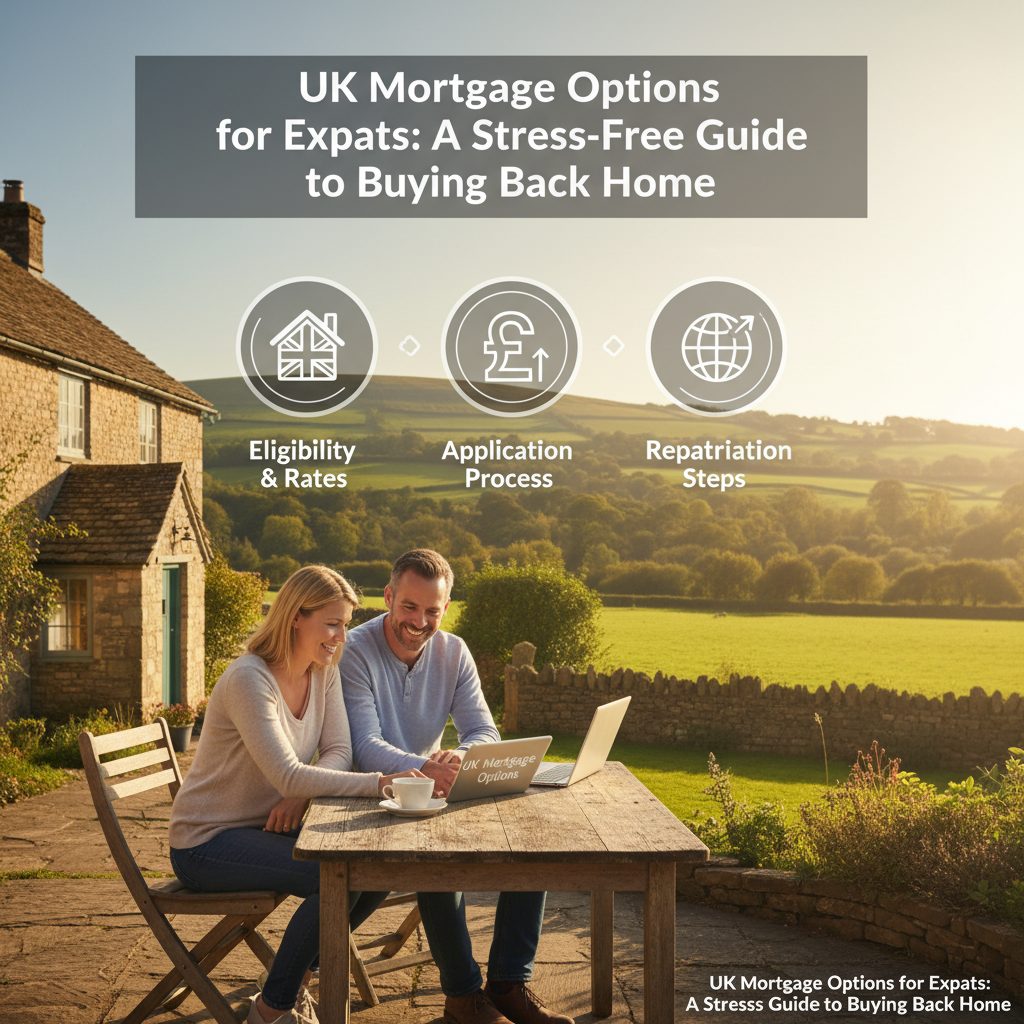

The Mortgage Application Process: Step-by-Step

Simplifying the journey to secure your expat mortgage is key. Here’s a general outline of the steps involved:

Gathering Your Documents

Preparation is everything. You’ll need to compile a comprehensive set of documents, which typically includes:

- Your passport and proof of current address.

- Detailed income statements (payslips, employment contracts, tax returns for self-employed).

- Bank statements (often for the last 6-12 months).

- Proof of deposit funds.

- Existing credit reports from your country of residence.

Pro Tip: Have everything meticulously organised before you begin. It speeds up the process significantly.

Finding the Right Mortgage Advisor

This is perhaps the most critical step for Navigating UK Mortgage Options as an Expat. Specialist expat mortgage brokers are invaluable. They possess deep knowledge of the market, understand the complexities faced by expats, and know exactly which lenders are expat-friendly. They can save you time, stress, and potentially money by guiding you to the best deals.

Common Hurdles and How to Overcome Them

Even with a clear guide, you might encounter a few bumps. Here’s how to tackle them:

- Lack of UK Credit History: If you have limited or no UK credit history, consider opening a UK bank account, registering on the electoral roll (if applicable), and getting a UK credit card to slowly build a profile.

- Currency Fluctuations: Some lenders may require a larger deposit or implement stress tests to account for potential currency swings that could impact your ability to repay.

- Complex Income Structures: For self-employed expats or those with multiple income streams, providing detailed and clear accounts from a qualified accountant is essential.

Making Your UK Home Dream a Reality

While Navigating UK Mortgage Options as an Expat requires careful planning and a bit of homework, with the right advice and preparation, your UK home dream is well within reach. Don’t let the distance deter you from securing your ideal property. Embrace the journey, seek expert guidance, and soon you could be holding the keys to your new UK home!